Stilt Will help while Covered by DACA or even in the new U.S. on the a visa

Moving to the fresh You.S. should be a difficult task for many people. Immigrants often deal with challenges which have strengthening cash, providing money and you will carrying out an alternate lifetime from inside the another country. Carrying out the social networking sites and you will finding economic liberty takes time and you will effort.

One of the biggest challenges is getting a checking account or acknowledged to have funds, particularly without a working credit rating, however it need not be. Creditors are not planning accept an application as opposed to a great credit score, despite a keen immigrant charge.

Other challenge gets a personal Protection Number (SSN), and that is difficult and packed with legal and you may qualification things, files issues or other hurdles.

Luckily, a number of high alternatives are available to assist You.S. immigrants carry out their cash, take finance and create borrowing. Fintech organizations including Stilt will help if you’re included in Deferred Step to have Youthfulness Arrivals (DACA) or in the latest You.S. with the a visa.

Discover a merchant account, Score that loan and construct Borrowing That have Stilt

Stilt was an internet program giving immigrants that have checking levels, funds, remittances and you will borrowing from the bank builder factors. The firm works with people typically seen as high threats, such as for example charge holders, DACA holders, refugees and asylum applicants.

The firm is mainly based because of the Rohit Mittal and you will Priyank Singh, one or two globally students exactly who failed to get approved having loans throughout the U.S. at that time. According to an interview which have Forbes, both of them looked after the challenges out of accessing financial functions given that immigrants and you will wanted to perform a buddies in order to serve someone else instead of Social Protection numbers otherwise borrowing records.

Since the starting their travel and you may founding the business more five years back, Stilt enjoys helped tens of thousands of immigrants with lending products. The company enjoys saved him or her many in the charge and you may attention. Research from TechCrunch detailed one Stilt just closed an effective $one hundred million round from resource during the early 2021.

Do not let a credit rating Prevent You

Unlike typical loan providers, Stilt will not depend solely on the credit history so you can agree a great application for the loan, and you can pages don’t require a co-signer. Consequently, users with minimal borrowing from the bank otherwise the immigrants continue to have monetary possibilities. Stilt investigates other variables like most recent a career, degree, choices and you will any past bankruptcies when looking at the application.

Monetary Account Designed for Immigrants

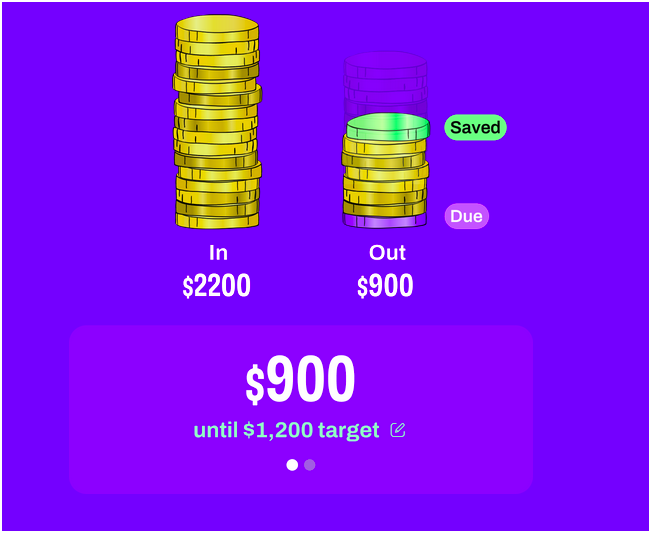

Configurations and you can registration with Stilt often takes on the five full minutes. Account citizens gets an online debit card and become ready to expend, save your self and create their cash. Its a great way to get yourself started building your finances and dealing on the the long term.

More importantly, Stilt doesn’t charges people overdraft costs, and it has no criteria getting minimum dumps. The organization provides digital and you may real debit notes, person-to-person transmits, plenty of confidentiality and security features, and an easy-to-have fun with app to possess members.

If you are searching to find that loan or make borrowing from the bank with Stilt, listed below are some of your qualification criteria to get started:

Most Charge Systems Approved

Stilt has no need for a personal Security Matter otherwise eco-friendly credit to apply. But not, you must be myself found in brand new You.S. and also have a bank checking account on your term of the an excellent U.S. address. If you don’t have a checking account, you could open a merchant account that have Stilt basic following apply for a loan later.

- CPT

- Opt

- H-1B

- O-step one

- TN

- J-1

- L-1

Get that loan From Stilt

- Your own personal guidance

- How much money you prefer inside You.S. bucks

Owing to Stilt, financing quantity start from $step one,100000 to $35,100, that have restrict mortgage terms of up to three years. There are no prepayment punishment, so you’re able to pay-off the loan very early with no additional charge or focus.

Aggressive Rates

By https://elitecashadvance.com/personal-loans-ne/atlanta/ using Stilt, personal loan rates of interest might be less than regular loan providers, especially for immigrants with limited credit score. Like that, immigrants get that loan and start strengthening borrowing and you will good upcoming.

Consumer loan interest rates can vary regarding 6 % to help you thirty six per cent, considering . Because of the starting an account which have Stilt, immigrants could work for the boosting the borrowing; this could in the course of time end up in straight down rates of interest for money. Thus, discover an account and possess started now.

Coping with Stilt could be one of many blocks you need ensure it is, build your borrowing and you can pursue your «American dream» after you proceed to the brand new U.S..

Stilt is designed to generate loans trouble-free to possess immigrants, charge proprietors, DACA proprietors, refugees and you may asylum applicants. Discover more here and you will fill in an online loan application regarding the spirits of settee .

Brand new contents of this article is to possess educational motives merely and you may will not make-up monetary otherwise financial support advice. You will need to do their look and you will believe looking to guidance regarding a separate economic professional before making any money conclusion.