You’ve arrived in the new You.S. because the a keen H-step 1 B visa holder with work in-line and you may thrill in regards to the coming in the future. That which you don’t possess, but not, try money to cover every expenditures a part of moving to a different country.

As you may find it challenging to get that loan, you do have options. This is what you have to know on the being qualified getting your own loan to possess H-1B charge holders.

Is H-1B Charge Proprietors Score Unsecured loans?

For folks who have relocated to the fresh U.S. off installment loans for bad credit Magnolia their places, discover hurdles to getting signature loans. However it is you’ll. You can find H-1B consumer loan possibilities you’ll be able to be eligible for.

And getting a personal loan you certainly will help you by building the credit score . To help you in getting other types of credit inside tomorrow.

Unsecured loan Conditions

For personal loan, there are personal bank loan standards you need to fulfill to help you getting acknowledged. These can start around bank to financial. Generally, loan providers will look at your credit rating. Your work also should be confirmed. On top of that, you may have to fulfill a living endurance otherwise keeps a beneficial specific personal debt-to-earnings ratio private loans. Debt-to-income ratio (DTI) compares their gross monthly money with the month-to-month financial obligation payments such as for instance playing cards.

Personal bank loan Lender Concerns

Basic, really lenders want individuals for a powerful credit history. Any type of borrowing you built up is likely to nation wouldn’t be considered, unfortuitously. Even a personal loan out-of a credit partnership, eg good DCU consumer loan to have H-1B visa people, usually considers a person’s credit history to aid influence personal bank loan eligibility.

Also, since the H-1B charge is temporary, particular loan providers get envision your a top exposure. They are concerned that you’re going to return to the country just before paying down your loan.

Advantages of Taking out an unsecured loan having a keen H-1B Charge

If you intend towards staying in the fresh new U.S. for any time period, you’ll want to create your credit history and credit rating in order to be eligible for greatest financial support possibilities later. Taking right out a personal bank loan and you can and come up with your own payment for the date per month may help build your credit history. Generally, the greater financial duty your show, the fresh new more powerful your own credit can become.

Like that, if you choose to pick a property otherwise an automible off the road, some think it’s easier to rating financing and you may be eligible for funds that have all the way down rates of interest.

Tips for H-1B Owners Seeking Unsecured loans

When the a personal loan having H-1B proprietors seems like a great fit to you, below are a few unsecured loan acceptance tips to help you.

Do a bit of investigating online discover loan providers who’ll render private money in order to H-1B visa holders. For each lender is always to list its mortgage criteria. This will leave you a sense of those could well be prepared to manage H-1B visa holders.

2nd, gather one data files needed to incorporate. They truly are your photos ID, possibly their charge, proof employment, proof money, and you can income tax come back comments, when you yourself have them.

Next, get preapproved for a financial loan . This will be a system to determine whether or not your be eligible for a loan. If you do, you will observe what interest rate and you may conditions you may be eligible having. Once you have several preapproved also provides, you might buy the only toward reduced interest.

Alternatives so you can H-1B Personal loans

A consumer loan having H-1B charge owners isn’t their sole option locate accessibility money to help cover costs. Check out other available choices.

Payday loan

An online payday loan is a primary-identity mortgage you to charges charges for the money you acquire and you will features a very high interest rate. Typically, a quick payday loan has actually good fourteen-go out installment label. When you find yourself able to pay they within this that a couple of-week several months, it would be a substitute for believe. But if you can’t pay the borrowed funds for the reason that timeframe, the loan could be rolled more than and will also be billed a great deal more costs.

Regarding payday loan against personal loans you will find one another benefits and drawbacks. Make sure you completely understand exactly what these financing include before you could get you to.

Family Financing

When you have members of the family who can give you currency to get paid, this may be your own safest and most affordable sort of resource. The only drawback is that you is not able to create borrowing with this solution.

Playing cards

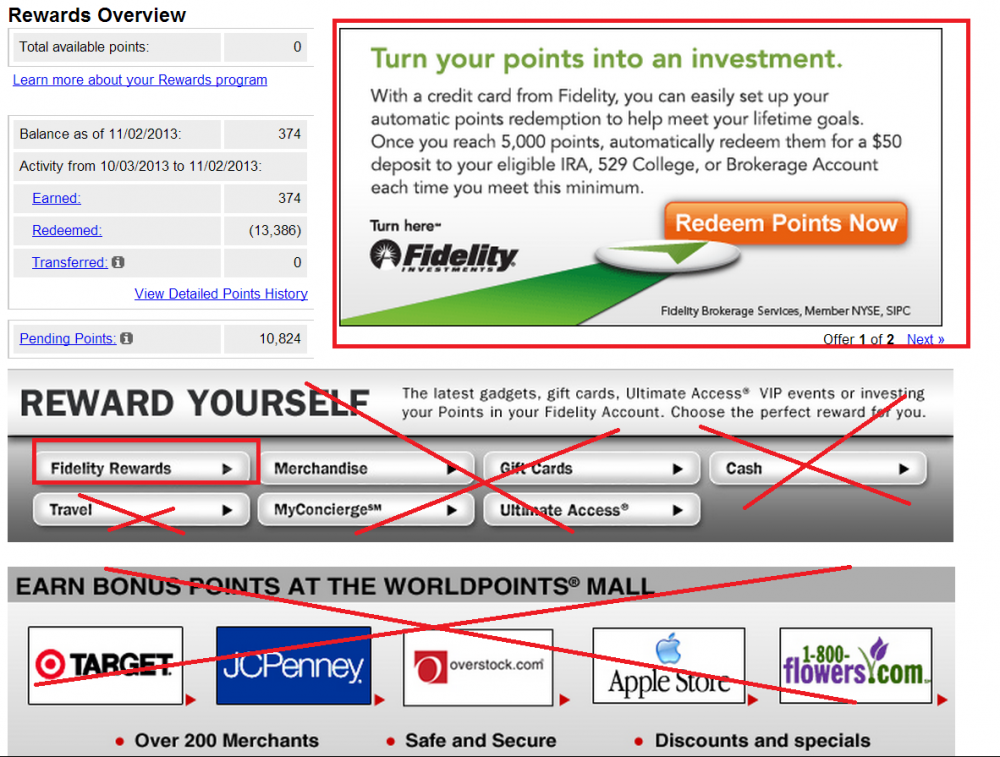

People whom relocate to this new U.S. be eligible for credit cards, which they are able to use buying what they need. Specific playing cards bring rewards, and factors shall be earned with each pick which might be used to have such things as take a trip and cash back.

There are many different differences when considering a personal bank loan versus credit cards , so be sure to are very well versed regarding the terms of both before applying to possess often.

Personal loans and you may H-1Bs: The brand new Takeaway

Taking out an unsecured loan as an enthusiastic H-1B visa proprietor can be problematic, however it is you’ll be able to. Although extremely loan providers play with another person’s credit score to choose loan eligibility, particular lenders are prepared to manage HB-step 1 visa proprietors. Do some research to acquire loan providers that do thus, and get preapproval. Immediately following you’re preapproved, you can look for a financial loan into the top words and reasonable rate of interest.

step 3 Personal loan Information

Doing your research helps ensure your obtaining the cheapest price your can. Lantern because of the SoFi helps make this easy. Having one to online software, there are and evaluate unsecured loan also provides out-of numerous loan providers.

In case the interest rates you are to be had check way too high, try lowering the loan amount. Generally, the higher the loan, more the chance having lenders, whom most likely charges a top rate of interest into enhanced chance height.

Be cautious about lenders exactly who encourage guaranteed fund. Genuine lenders may wish to see your own creditworthiness in advance of providing a beneficial loan.